Changes to how your arranged overdraft is shown

We’re giving you a clearer view of your remaining overdraft

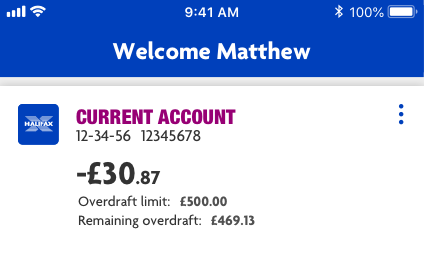

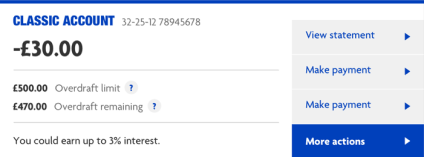

We’ve heard your feedback on the recent changes to how we show your current account balance in Online Banking. We've now introduced ‘remaining overdraft’ – so if you use your arranged overdraft you’ll be able to see instantly how much you have left. This means you won’t need to work it out yourself.

Here’s how the new overdraft display will look online

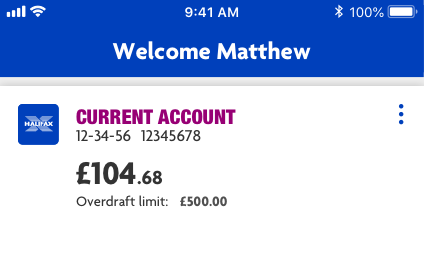

In the Mobile Banking app:

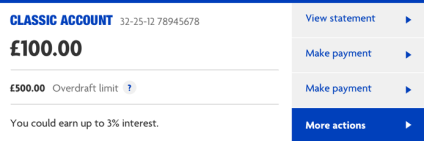

In Online Banking:

A reminder of the changes to how we show account balances

To meet a new regulation that all banks must follow, in November 2019 we changed how we show your balance. Previously your ‘available balance’ included your arranged overdraft limit. Now you see your actual account balance separately to your arranged overdraft limit, if you have one.

You can still use your overdraft in exactly the same way as you did before. The main difference under the new regulation is that we can’t show your account balance and overdraft as one amount any more.

We also changed how balances are displayed on our cash machines. Other banks are doing the same, so if you use another bank’s cash machine to check your balance it might look different there too.

Any questions?

If you’d like to talk to us about your bank account or overdraft, please call us or pop into your local branch.

Download the Mobile Banking app.

To make sure you can see these changes on your Mobile Banking app, you can download the latest version from your app store.