Go paper-free

Amend paper-free preferences for your statements and communications.

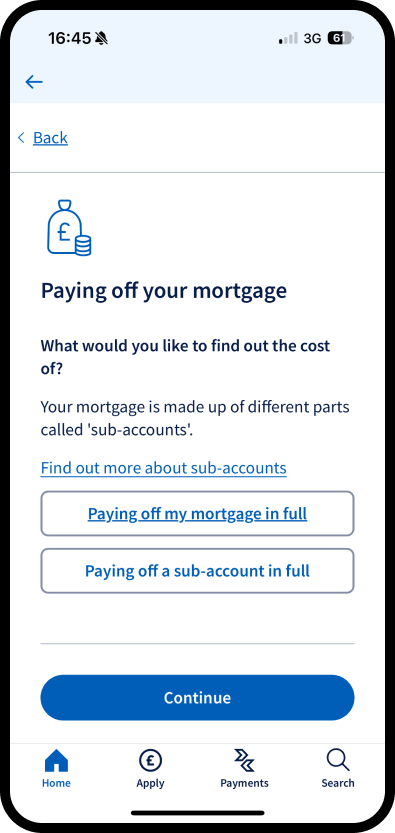

Follow these steps to pay off your mortgage. Complete the instructions in this order, otherwise your regular payment could also be taken.

This is the quickest way to get your redemption statement.

If you don’t bank online, you can do any of the following:

Doing that, we can then send you a redemption statement by post to your registered address.

Pay off your mortgage in full with any of these options. With any option, check for any payment limits and payment timescales with your bank before choosing your date and making any large payments.

Also, check your details are up to date in case we need to refund you after you’ve paid off your mortgage.

You can pay off your mortgage in full using our app or online banking. Simply log in and select ‘Pay & transfer’ if you’re using the app or ‘Payment and transfers’ in online banking.

Then make your payment to the account below:

Sort code: 30-15-99

Account number: 00580006

Account name: Halifax

For the payment reference, use your mortgage account number and add ‘00’ on the end. This will give you a reference number that’s 16-digits in total.

Remember:

To pay off your mortgage in full using another bank account, you’ll need these details:

Sort code: 30-15-99

Account number: 00580006

Account name: Halifax

For the payment reference, use your mortgage account number and add ‘00’ on the end. This will give you a reference number that’s 16-digits in total.

Remember:

To pay off your mortgage in full by phone:

The most you can pay by phone in one go is £60,000, but you can make more than one payment per day.

If you have a hearing or speech impairment, you can contact us using the Relay UK service. There’s more information on the Relay UK help pages. If you’re Deaf and a BSL user, you can use our BSL SignVideo service.

If you need assistance, are struggling for other reasons or can’t use other ways to pay, this might be your best option.

Make all cheques payable to 'Halifax'.

On the back, write your 14-digit mortgage account number and add ‘00’ on the end. This will give you a number that’s 16-digits in total.

Post it to:

Halifax,

Barnett Way,

Gloucester,

GL4 3RL

You can also pay in your cheque at one of our branches.

Paying by cheque is a much slower method to use. It takes 15 days for the money to appear in your account. Make sure you leave enough time if you pay by cheque.

If you pay through a solicitor, your solicitor should have requested a redemption statement from us. The statement will include the CHAPS details and reference number for payment.

You can pay from a branch if you:

You’ll need to bring details of where the payment is coming from.

Remember:

If in our branches

If you have a hearing or speech impairment, you can contact us using the Relay UK service. There’s more information on the Relay UK help pages. If you’re deaf and a BSL user, you can use our BSL SignVideo service.

Do I need a solicitor to pay off a mortgage?

You’ll only need a solicitor to pay off your mortgage if you’re remortgaging to a new lender, moving home or if there’s a second charge on your property. In these situations, a solicitor handles any legal charges and Land Registry details.

If you’re paying off your mortgage in full and none of the above apply, you won’t need a solicitor.

What’s included in the redemption figure and statement?

Your redemption statement will show the total amount you need to pay. It’ll include any recent payments, interest charges, ERCs and other fees.

Why’s my balance different to the redemption figure?

Mortgage balance is how much you still owe on your mortgage. This is not a redemption figure as it doesn’t include any early repayment charges or any other costs or charges that may be payable.

What’s the quickest way to get a redemption figure?

You can get this in the app or through online banking. A breakdown of all fees and charges will be included.

How long does a mortgage redemption statement last?

The mortgage statement is valid up to and including the date selected. If the date changes or the mortgage is not paid off by the selected date, another statement will need to be requested.

What are ERCs and how much will I need to pay?

Some mortgages have charges for repaying all or part of the mortgage back within a certain time. We call these early repayment charges (ERCs). You can find out how much you are likely to pay by requesting your redemption statement in the app, online banking, or by post.

When are ERCs applied?

The ERC is calculated and applied on the date we receive your payment. It might be best to wait until your ERC percentage lowers or ends before you make a payment. For example, if your statement shows your ERC percentage will go down on 01 July, making your payment on 30 June might mean paying more.

Is my next direct debit included in the redemption figure?

No. A redemption figure doesn’t include the next scheduled direct debit.

The direct debit process starts 5 days before it’s due. If you pay off your mortgage once this has started, the direct debit will still be taken. If this happens, it could take up to 15 days for it to be refunded. Take this into consideration when you select the date you want to pay off your mortgage.

I have less outstanding on my mortgage than the next direct debit due. Will you only collect the outstanding amount?

No. We’ll collect the normal direct debit amount. Any extra amount will be refunded back to you once your mortgage is closed.

Will I need to cancel my direct debit?

If you paid your mortgage by direct debit, we’ll cancel it automatically.

Will I need to cancel my regular payments?

Direct debits

If you paid your mortgage by direct debit, we’ll cancel it automatically.

Standing orders

Cancel your standing order with your bank after your mortgage account is closed.

When will I get confirmation of payment?

You’ll receive confirmation that your mortgage has been repaid within 15 days of payment.

It can take several days for the payment to show in the app or in online banking. Once we’ve processed the payment, we’ll close your mortgage within 15 days. After that, it won’t show in Hello Home when you log in.

Why has my direct debit been taken after I’ve paid off my mortgage?

The direct debit process starts 5 days before its due. If you pay off your mortgage once this has started, the direct debit will still be taken. If this happens, it could take up to 15 days for it to be refunded. You’ll receive a refund for any direct debit taken in this situation.

I paid too much, when will you refund me?

If you’ve ended up paying too much, we’ll pay you back the outstanding money within 15 days. You’ll receive your refund back to the account your direct debit comes from. Check your details are up to date.

If you haven’t received an expected refund, this will be sent once the mortgage has been closed. You should expect your mortgage to be closed within 15 days.

You can expect your mortgage to be closed within 15 days of the final amount being paid.

When will I get my property deeds?

When will the legal charges be removed?

What about my insurance?

You should review your insurance cover to make sure it still meets your needs.