Go paper-free

Amend paper-free preferences for your statements and communications.

Critical illness cover from Scottish Widows. Get a quote today. To help with peace of mind for you and your loved ones.

Get your quote now Get your quote now.

Imagine having the peace of mind knowing that, in the event of a serious illness, you won’t have to worry about the financial burden.

Critical illness cover could pay you a cash lump sum if diagnosed with an illness covered by your policy.

This cash lump sum could have the power to ease you and your family’s everyday expenses. Allowing you to focus all your energy on your health and wellbeing.

To apply for cover, you must:

You do not need a medical exam, and you'll get your decision the same day.

Duration: 1 min 30 secs

Discover how critical illness cover could support you and how to easily get started with a quote.

Could receiving a lump sum relieve your financial stress if you were diagnosed with a serious illness?

Critical illness cover could help ease money worries at a tough time, letting you focus on getting better.

Your insurance provides a tax-free lump sum if you're diagnosed with a covered condition while your policy is active, and with your cover, you can access virtual GP appointments with real doctors, get repeat prescriptions, and if you're diagnosed with an early stage cancer, you could get an early help payment of £5,000.

You might be surprised how affordable critical illness cover can be.

Your monthly payment depends on the amount of cover you choose and how long you want it to last.

It costs more as you get older, so the best time to act is now.

Over a five year period £432 million was paid out in critical illness claims, helping thousands of our customers when they needed it most.

This money goes directly to you, tax-free, to use however you want.

Not sure where to start?

Check out our quick quote tool in the app or on our website.

It'll only take a few minutes to see how much your cover could cost.

You can find more information about insurance options in our app and on our website, or speak to a protection expert for free, personalised advice on Scottish Widows policies.

Get 12 months of Disney+ (Standard With Ads) when you purchase a new protection policy directly with us.

With blockbuster movies, new originals, and much-loved shows, there’s something for everyone to enjoy.

Stream endless entertainment and relax, knowing we’ve got you covered.

Your subscription starts after you make your first payment.

We can amend or withdraw this offer at any time. Terms and conditions apply.

Critical illness cover might be right for you if:

If you are too ill to work for an extended period, how much would you need to help your loved ones.

Consider the help you might need to keep up with:

The amount of cover that's right for you depends on a few factors. If you are too ill to work, what kind of support would you and your loved ones need?

Choose the amount of cover that's right for you and your loved ones.

It might help to think about life’s milestones, like the number of years until:

We can offer cover from 5 to 40 years, up to age 69. If you are over the age of 59, you will need to call us to discuss your options.

Critical Illness cover policy document (PDF, 800KB)

Critical illness cover terms and conditions (PDF, 871KB)

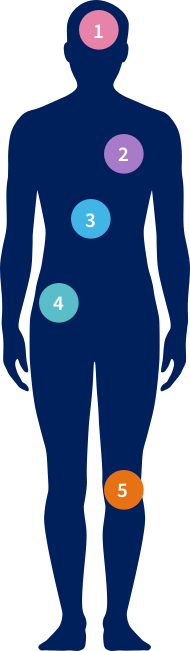

The image highlights the illnesses we cover and when you can claim. These headings are only a guide. For full details, refer to the terms and conditions.

You can claim for the early help payment more than once for any other unrelated early stage cancer.

If you've got more than one Plan and Protect policy, we'll only pay one early help payment across all of your policies.

Your cover will continue. You can go on to make a full claim for any of the illnesses we cover.

This table shows what the price might be, based on your age group. It shows how the monthly cost you pay for life insurance can be lower if you take it out sooner.

50% of our customers paid these prices or less for single level Plan & Protect critical illness cover bought online between 31 January 23 and 31 January 24.

Note, the sample size for 18-25 critical illness is 122 and 51-59 critical illness is 170.

Prices are subject to underwriting criteria that depend on personal circumstances and are subject to change.

You can use critical illness cover in various ways, including:

There are different types of critical illness cover available. We offer level critical illness cover online. Here's how it works.

Our life insurance is provided by Scottish Widows. They're a part of Lloyds Banking Group, like us. Scottish Widows are our life insurance experts, and they've been protecting what matters most for over 200 years.

Here are a few reasons why they could be the right choice to protect you and your loved ones:

Scottish Widows protection products have no cash-in value at any time. So if the policy ends without a claim, you won't get any money back. If you don't make payments on time, your cover will stop, your policy will end and you'll get nothing back.

Our Halifax protection experts are here to help find the cover that is right for you.

They'll help you with Scottish Widows life insurance policies, critical illness cover, or both.

They won't charge you for their support and you don't need to take the product as a result of speaking to them.

Call: 0800 131 0551

Lines are open Monday to Thursday 9am to 7pm, Friday 9am to 6pm.

Or ask for a call-back at a time that suits you.

Lloyds Bank Insurance Services Limited provides this service, which is also part of Lloyds Banking Group.

Scottish Widows works closely with partners like Macmillan. They help make sure our customers get the right help, at the right time.

So if you're diagnosed with a critical illness and need to make a claim, they can put you in touch with one of our partners, if that would be helpful. They can give you a bit of extra support, when you need it most.

This kind of cover could pay out a cash lump sum if diagnosed with an illness, covered by your policy before it ends. It's designed to help you and your loved ones meet day-to-day costs. This can let you focus on your own health and wellbeing.

You’ll choose the size of the cash lump sum that will get paid out when you make a successful claim. You’ll also choose how long you want cover for.

You’ll pay a fixed amount each month by direct debit, until your policy ends. Your policy doesn’t have a cash-in value. This means that if it ends without a successful claim, then you won’t get the money back.

Scottish Widows might not be able to help if you have a pre-existing condition. But if they can't offer you a policy, they'll let you know how to get more help or advice.

Our Halifax protection experts are here to help find the cover that is right for you.

They'll help you with Scottish Widows critical illness policies.

They won't charge you for their support and you don't need to take the product as a result of speaking to them.

Call: 0800 131 0551

Lines are open Monday to Thursday 9am - 7pm, Friday 9am - 6pm.

Lloyds Bank Insurance Services Limited provides this service, which is also part of Lloyds Banking Group.

Life insurance costs vary according to how much cover you need, your age, and other factors such as your health history.

No. Your policy only pays out if you make a successful claim. If your policy ends without a successful claim, then your cover will end, and you won’t get any money back.

Make sure you pay each month on time, or your cover could stop.