Go paper-free

Amend paper-free preferences for your statements and communications.

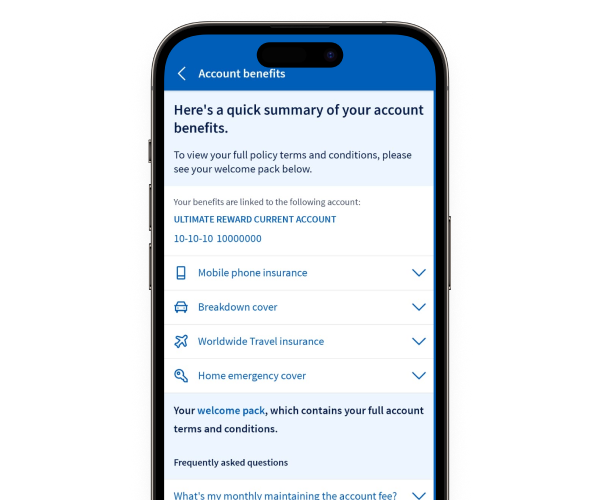

Let us show you step by step.

If you're not registered for online banking, you can call us. We also offer a range of other services in your local area.

|

Some key benefits |

Some important exclusions |

|---|---|

|

Some key benefits

|

Some important exclusions

|

|

Some key benefits |

Some exclusions and rights to refuse service |

|---|---|

|

Some key benefits

|

Some exclusions and rights to refuse service

|

|

Some key benefits |

Some important exclusions |

|---|---|

|

Some key benefits

|

Some important exclusions

|

|

Some key benefits |

Some important exclusions |

|---|---|

|

Some key benefits

|

Some important exclusions This policy is to deal with ‘home emergencies’ needing immediate attention only and will cover costs up to a maximum of £250. It does not cover broken freezers for example. |