Go paper-free

Amend paper-free preferences for your statements and communications.

The basics don’t change:

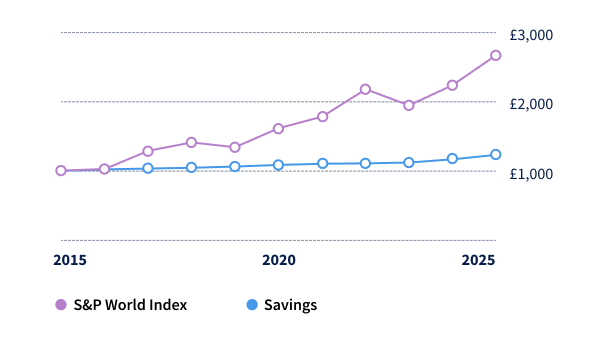

Of course, what’s happened before isn’t a guarantee of what will happen in the future. But it’s interesting all the same to compare the 10-year journey of cash savings and investments.

ISAs are one of the best ways to save and invest in a tax-efficient way. And from 06 April 2027, that matters even more:

As well as this, rates of Income Tax applicable to dividend income are changing.

From 06 April 2026, the basic rate will be increased by 2% to 10.75% and the higher rate will be increased by 2% to 35.75%. The additional rate will remain unchanged at 39.35%.

Using a Stocks and Shares ISA could help you stay tax-efficient.

Transfers keep your ISA tax benefits – but make sure you do it properly. Don’t take out the money into a normal account during the process. We can help with transfers.

If you're considering moving money between Cash ISAs and Stocks and Shares ISAs, think about your goals and make sure this decision is right for you. Cash is lower risk, but inflation can eat into its buying power. Investments can potentially offer more growth if you’ve got time on your side.