Go paper-free

Amend paper-free preferences for your statements and communications.

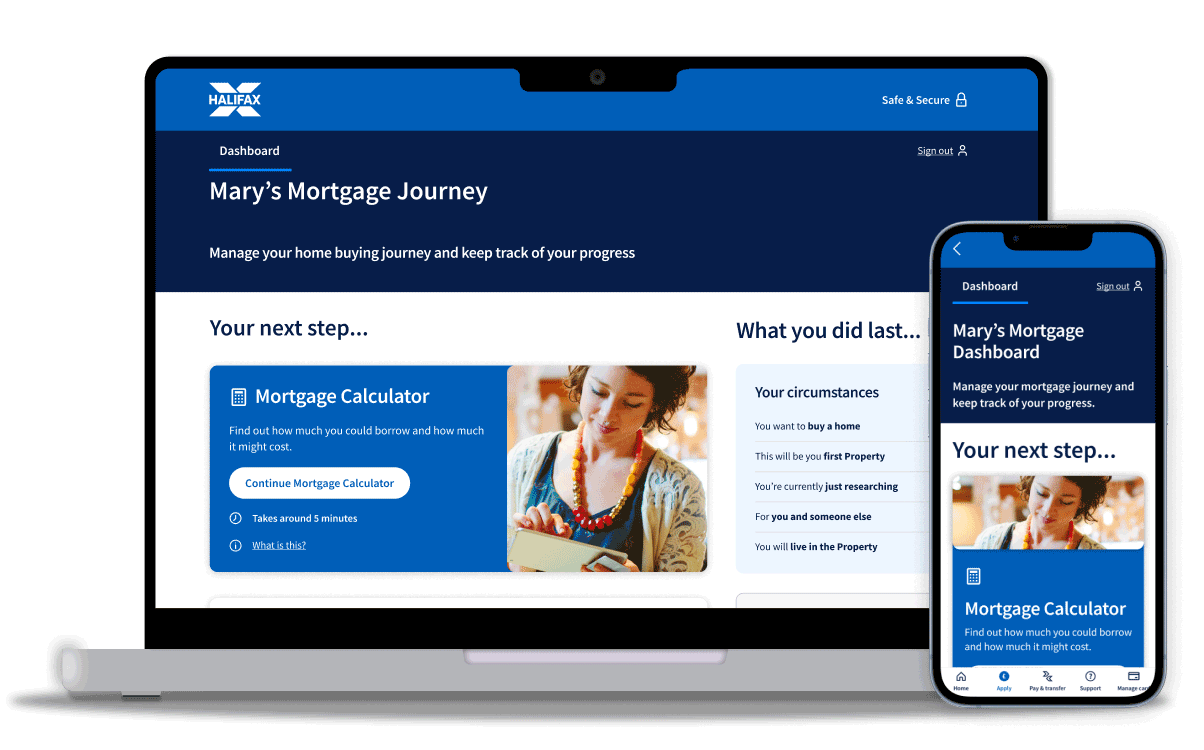

We make your mortgage journey simple

Track and manage your mortgage application online with your own mortgage dashboard. Upload documents, pick valuation options and get support, all in one place.

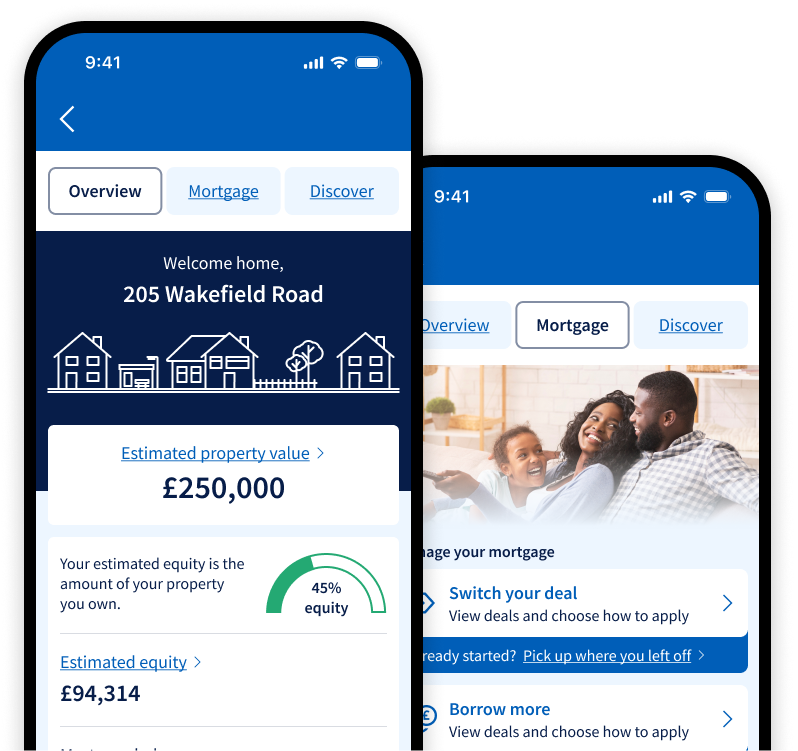

HelloHome on the Halifax app lets you track your rate and payments. Learn about your property value and equity. Even switch and save on household bills.

Learn all you need to know about moving your mortgage with our handy remortgaging guides.

Remortgaging is when you take out a new mortgage deal on the same property but with a different lender. You might want to consider remortgaging if your current deal is ending. This is different to switching to a new deal with the same lender.

When you remortgage, it usually means paying off your existing loan with your new mortgage deal. Then, you’ll continue making repayments to your new lender.

A small change can make a big difference. There’s plenty of reasons why you might want to remortgage:

To remortgage to us, you’ll need the details of yourself and anyone else who is named on the mortgage.

We’ll also need the following:

There are various steps involved in the process, so it all depends on how long each step takes. This can depend on your circumstances.

Learn more in our guide to the remortgage timeframe.

When you remortgage, the amount you could borrow depends on various factors. This includes how much your home is worth and how much you owe on your current mortgage deal.

We’ll assess how much we think you could afford to borrow, if you can borrow more than you owe and if you’ll need to pay a deposit.

Our Remortgage Switcher Service means we won't charge you for the survey of your property and we'll also pay for your basic legal work.

You'll have to pay for any legal advice you need. When you apply, you'll be able to confirm whether you are happy to use this service. If you choose not to use our Remortgage Switcher Service, you must arrange and pay for these services yourself.

Watch our video on the remortgaging conveyancing process to find out more, including a handy checklist of what you’ll need to do.

Our free basic legal work includes:

You may need to pay other legal fees in some cases, such as:

Our conveyancers will let you know if any other legal fees apply.

For more information on basic legal fees and the remortgage conveyancing process, watch our handy video.

If you’re looking to borrow more when you remortgage, we’ll first need to find out how much equity you have in your home. We’ll also need to understand your other financial commitments.

Our decision to lend will depend on your circumstances. If you’ve already borrowed against your mortgage to consolidate debt within the last 5 years, we won't be able to offer extra borrowing to help pay off your debts again.

Before you choose to borrow more against your home, it’s worth looking at other borrowing options.

When your current mortgage deal ends, your loan will usually be transferred to a Standard Variable Rate set by your lender – unless you choose to remortgage to a new lender or switch to another deal.

It's sometimes possible to take a product rate with you to a new mortgage on a different property. This is known as porting a mortgage rate. Your Mortgage Illustration and offer letter will say if your rate is portable.

When you apply for a remortgage with us, you do not need to do a mortgage agreement in principle.

If you want an idea of how much we could lend you, then you can apply for an AIP. It won’t affect your credit rating.