Go paper-free

Amend paper-free preferences for your statements and communications.

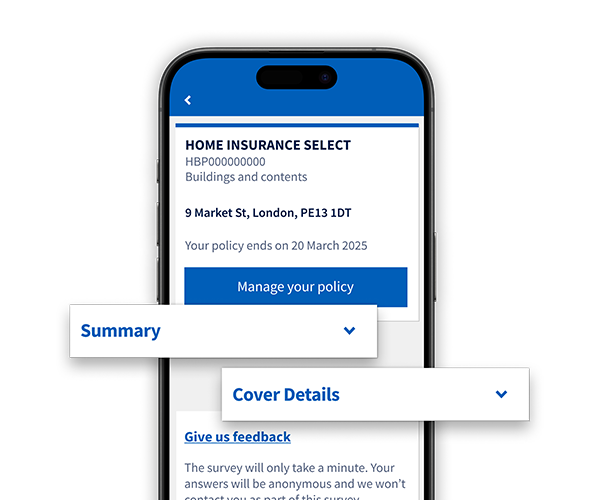

You can do most things online without knowing your policy number, so you don't have to call us.

Here are some of the most common questions people have about their policy.

If you're registered for online banking, you can:

You can register using your home insurance policy if you have another account with us.