Go paper-free

Amend paper-free preferences for your statements and communications.

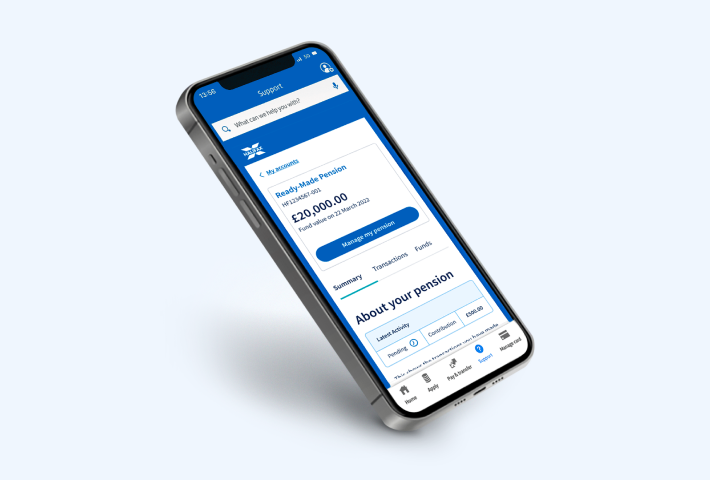

Maximise your annual allowance this tax year with our expertly managed Ready-Made Pension.

A Halifax Ready-Made Pension makes saving for retirement easy and hassle-free.

Almost anyone in the UK under the age of 75 can save into a Ready-Made Pension.

If you have old pensions that you no longer pay into, you could benefit from combining them into one pot – making it easier to manage.

If you’ve never saved into a pension, now could be a good time to start. Choose how and when you contribute - it’s never too early to start thinking about your retirement.

Even if you have a workplace pension, a personal pension may give you more control over your retirement savings. It could also help you make the most of your annual allowance (see our FAQs).

If you work for yourself, you won’t have a company pension scheme to rely on. If you want to start planning for your retirement, we can help.

For every £80 you put into your pension, HMRC will usually add an extra £20. If you’re a higher or additional rate taxpayer, you could also benefit from extra tax relief through self-assessment. Tax treatment depends on individual circumstances and may be subject to change.

We want to make it easy to save for your retirement. That’s why we do the hard work and invest for you through our partners, Scottish Widows.

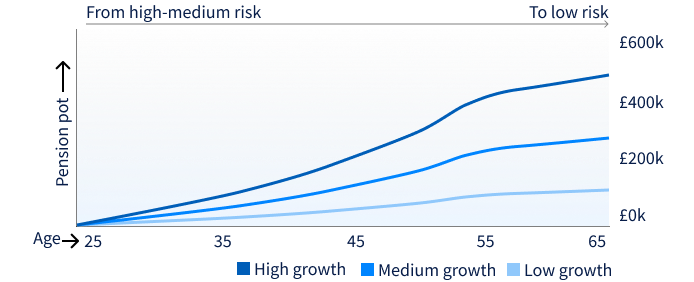

We invest your pension based on the age at which you’re planning to retire.

If you’re years away from retiring, we invest to give you the best chance of growth. As you approach retirement, we move your portfolio into lower-risk investments to help protect your pension value.

For more information, please see the Ready-Made Pension Investment guide (PDF, 167 KB) and "Our funds' past performance" below.

Please note that this graph is a guide for illustration purposes only and not a reliable indicator of future performance.

The potential performance of a £10,000 initial investment and £250 monthly contribution from age 25 (minus charges of 0.7% and adjusted for inflation at 2%). By age 65, this could result in a pension value of up to £113,995 if markets achieve a low growth of 3% per year. Alternatively, this could also be £229,718 for 5% growth, or £512,614 for 8% growth.

Our Retirement Portfolios invest in funds that are managed by our expert investment partner, Scottish Widows.

The funds are from their “Manage Growth Fund’ range, which invest in stocks and shares (also known as equities), fixed interest investments (also known as bonds) and Property. You tell us the age at which you expect to retire, and we’ll invest your money in a Retirement Portfolio that targets the five-year retirement period in which you told us you expect to retire.

For example, someone who’s 40 in 2024 and wishing to retire at 60, would be placed in a Retirement Portfolio that targets the years 2041-2045. We’ll then use a process called ‘lifestyling’ to gradually reduce the level of risk in your portfolio as you get closer to retirement.

If you take out a Ready-Made Pension more than 10 years from your retirement age, your Pension’s Retirement Portfolio will be fully invested in the higher risk Managed Growth Fund 6, to give you the best chance of growth. This is the ‘Growth phase’. As your Retirement Portfolio reaches 10 years before its five-year target retirement date range, it moves into the ‘De-risking phase’, when the risk level of your investment starts to be reduced each year, through lifestyling.

We gradually move some of your Pension from the higher-risk fund into our Managed Growth Fund 2, which is a lower-risk fund. Although this reduces the growth potential of your Pension, it also aims to help protect what you’ve built up if there are any downturns. When you reach the five-year range of your chosen retirement age, your Retirement Portfolio will move into the ‘At Retirement Phase’. From then on, most of your Pension will be invested in the Managed Growth Fund 2.

Everything happens automatically so you don’t have to worry about it. To help you understand how the funds have performed over a longer period, see our graph below. This goes back 5 years and shows the percentage of growth in the fund over time and is not a reliable indicator of future performance. The performance data includes the ongoing charge and all transaction costs within the fund, but does not include the 0.3% account fee.

Our Ready-Made Pension fees are clear and straightforward to make it easier to plan for your future.

You’ll need to pay an annual account fee and investment charge. What you pay will depend on how much you invest.

We won’t charge you for pension transfers – whether you’re transferring in or out. And we also don’t charge you to top up or drawdown your pension.

Our Ready-Made Pension offers flexible options so when the time is right, you can access your pension in a way that suits you.

You can also take your pension as an annuity, which guarantees a regular income for life (first 25% being tax-free). Our Ready-Made Pension doesn’t offer an annuity option. However, we can help you find an annuity provider if you want to take your benefits that way.

Please see the Retirement options page for more information.

Make sure you've read the key features document (PDF, 159KB) and terms and conditions (PDF, 255KB).

To apply, you must:

If you’re transferring, make sure any old pensions:

You’ll need your National Insurance number and, if transferring, the provider’s name, policy number and value of each pension.

No, you can transfer one or more older pensions, as long as the total initial value is over £10,000. This will open your Ready-Made Pension and once this is set up, you can add more pensions to it anytime in the future.

Please note that you can’t transfer every type of pension.

We can’t accept:

Pensions with guarantees

This is a pension with a Guaranteed Annuity Rate. It means you could get a higher income than you’d get at today’s rates when you retire.

Or

Guaranteed Minimum Pension or Section 9(2B) rights

These may provide you with a guaranteed income when you retire. You’re not likely to match this amount when transferring. Please check with your current provider, as they should have more details on this.

Or

Guaranteed Conversion Option:

This allows you to convert your pension into a fund, which gives you access to a wider, more flexible range of benefit options. At today’s rates, it’s unlikely that this fund will be worth as much as your original pension.

Pensions with defined benefits

Also known as final salary benefits, this is where you receive guaranteed pension income based on your salary, rather than how much you’ve paid in. Your current provider should have more details on this.

Workplace pension

A pension that you and an employer still pay into.

Other reasons you can’t transfer

Your pension may be with a provider outside of the UK. It could be subject to a pension sharing or earmarking order following a divorce or dissolution of a civil partnership. Or it has been, or will be, set up using disqualifying pension credits. This is when the pension sharing order is applied to a pension already in payment or income drawdown.

To see what you may get back from your pension, we’ll provide an example illustration when you apply. These figures are only examples and aren’t guaranteed – they’re not minimum or maximum amounts.

We’ll send you a personalised illustration when your Ready-Made Pension is set up.

Use our pension calculator as a guide to see what your retirement income could be. You can also see how making changes to your contributions could make a difference to your overall pension pot.

The Lifetime Allowance (LTA) limit for personal pensions was abolished on 6 April 2024. It was replaced by the Lump Sum Allowance (LSA), which is £268,275, and the Lump Sum Death Benefit Allowance (LSDBA), which is £1,073,100. The total number of tax-free lump sums, which can be paid from any pensions you have, is limited by these new allowances.

There’s no limit to how much you can save into a pension throughout your lifetime. But there is an annual maximum called the ‘annual allowance’.

You may still contribute the equivalent of 100% of your annual earnings each year. Or up to a maximum of £60,000 (whichever is lower). You can also carry forward up to three previous tax years’ worth of unused allowances.

Find more information about the Lump Sum Allowance at gov.uk.

One of the benefits of investing into a pension is tax relief. If the basic rate of tax is 20%, for every £80 you pay in, the government will top this up with an extra £20.

If you’ve told us you’re eligible, we’ll add basic rate tax relief automatically to any regular or one-off contributions you make into your Ready-Made Pension. If you’re a higher rate taxpayer, you can claim additional tax relief through your self-assessment tax return.

How much you can pay in without a tax charge will depend on your circumstances.

Tax treatment depends on your individual circumstances. Your circumstances and tax rules may change in the future.

If you would like financial advice, you could speak to an Independent Financial Adviser. Unbiased and Vouchedfor will let you find a local adviser based on your requirements. There will be a charge for this service.

You get free help and guidance through Pension Wise. If you’re over 50, you’ll also benefit from a free 60-minute appointment.

Alternatively, our partners Schroders Personal Wealth could also help. They provide personalised advice on a range of different products and services. It all starts with a free, no obligation chat, then a financial plan that’s tailored to you. To be eligible, you’ll have at least £100,000 in sole or joint savings, investments or personal pensions, or sole income of at least £100,000. Fees and charges may apply.

You may forget about a pension you already have. This could impact how much you can save for retirement.

For further support, you can go to The Pension Tracing Service, which is operated by the Department for Work and Pensions.