Go paper-free

Amend paper-free preferences for your statements and communications.

If you have an Ultimate Reward Current Account, you don't need to call to make a claim. You can do this in our app or Online Banking.

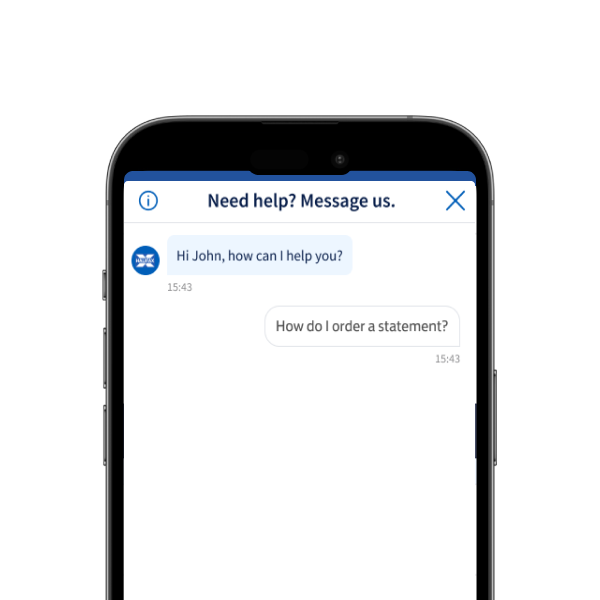

Get help and support without calling. Sign in to your app or Online Banking to get in touch.