Go paper-free

Amend paper-free preferences for your statements and communications.

With so many options available, understanding your financial goals can help you decide how to invest your money.

“I need to know what I’m saving for. Without a goal, it’s too easy to spend money on things I don’t need.”

John H, Halifax customer

What you do with your money will depend on your goals and timeframe but there are four key areas to consider:

Investing in stocks and shares is often thought to be complicated, or just something for the experts. It can, however, be a key part of a balanced financial plan. Options such as ready-made investments, can make it much easier for you.

Investments are not guaranteed to rise, their value can also fall, which means that you could get back less than you invested. Because of this, we would recommend you leave your investments in the plan for at least 5 years. This gives the best chance for potential growth.

It’s also important to put money aside in a savings account. It will give you steady growth and easy access to your money.

If you’re unsure about what you should do, get some financial advice, although there may be a fee for this.

Your investments may also be subject to tax. What you’ll pay, depends on your personal circumstances and may be subject to change.

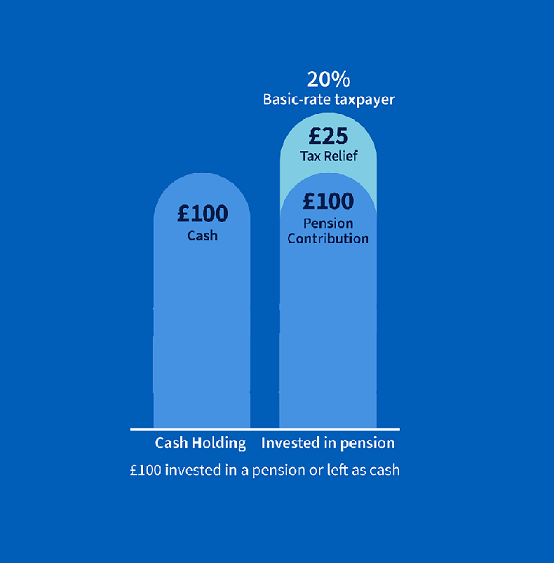

Topping up your pension pot can be a great way to build up your retirement savings. You could also benefit from tax relief on your contributions. If your basic rate of tax is 20%, for every £100 you contribute into your plan, the government will top up your pension with an extra £25.

Higher rate tax payers could also benefit from extra tax relief. This can be claimed directly from HM Revenue & Customs.

To save enough money for retirement, the 2024 Scottish Widows Retirement Report, recommends that you should save at least 12% of your income. If you have a workplace pension, your employer may match some or all, of what you pay in.

It’s worth remembering that extra money you put in to your pension, will be locked away until you’re at least 55 years old (increasing to 57 in April 2028). You may choose to look at different saving options if you need to access this money sooner.

There are also limits to how much you can pay into a pension in a tax year and still receive tax relief on. The tax you pay depends on individual circumstances and may be subject to change.

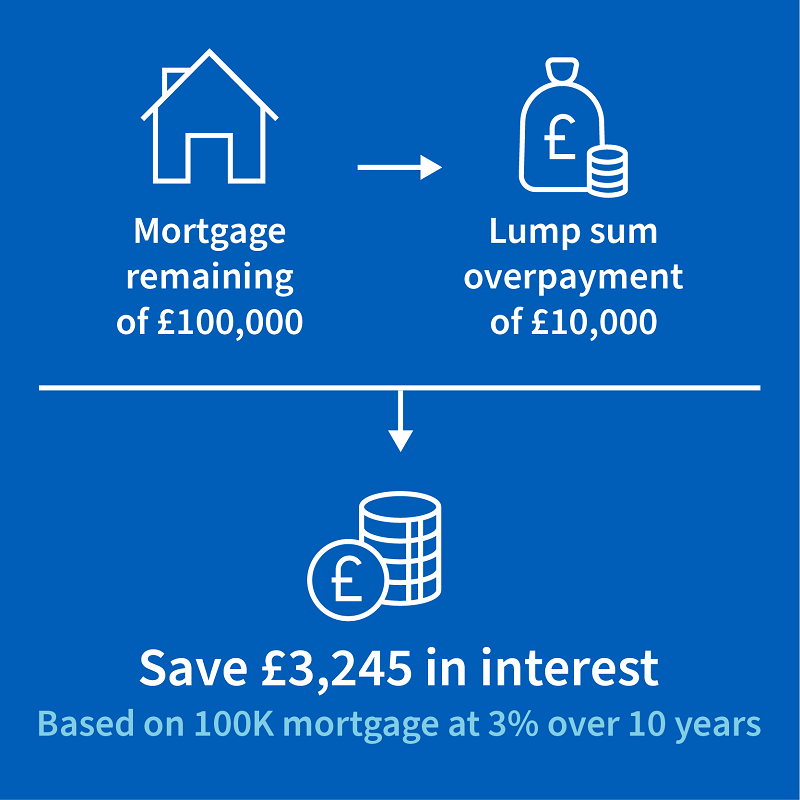

Paying off your mortgage as early as you can is a goal many people have. However, repaying any debts you may have, especially if they have high-interest rates, should be your priority. Once any high-interest debt is paid off, you could look to put extra money towards your mortgage.

If you are on a fixed rate that’s due to run out, you may be facing higher repayments. It could help if you can reduce the balance of your mortgage while interest rates are low. This will reduce the impact that an interest rate increase may have on your future payments.

Some mortgages allow a maximum of 10% overpayment each year. However, you may have early repayment charges to consider. Check with your mortgage provider to find out if you do.

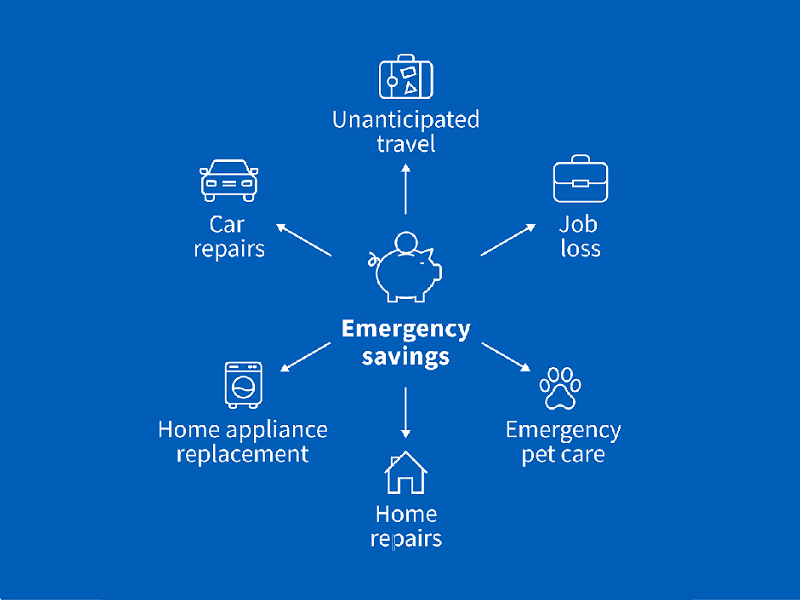

Savings are an important part of a financial plan. They can give you security, easy access and steady growth.

While helping with short-term goals and planned spending, savings are also important to help deal with unexpected emergencies. It's a good idea to create a savings fund equal to around 3 to 6 months of your outgoings. With the cost of living increasing, you may need slightly more in your 'rainy day' fund.

When saving, search for the best easy-access rate. Or, if you can tie up cash for more than 6 months, you might get a better rate with a fixed term savings account.

It will be different for everyone. But there are three things you should think about:

1. Get personal. Always consider your individual situation.

2. Get up to speed. Make sure you fully understand your options.

3. Go for your goals. Make decisions that best fit your financial goals.

Find out how inflation might impact you and your cash savings.

We have tips and tools to help you with budgeting, borrowing, saving or supporting others.

We’re here for the ups, the downs and everything in between.

Whether you're facing a tough time, or you need help managing your money, we’re here to help.