Go paper-free

Amend paper-free preferences for your statements and communications.

Fraudsters send messages to try steal your personal and banking details.

It’s important to stay vigilant against scam emails and texts. Fraudsters may pretend to be someone you know, tricking you to provide information they need to access your account.

Check the sender. Look for strange email addresses or phone numbers.

Watch for urgency. Scammers often try to rush you into sharing your details or sending money for something quickly.

Take care with links. Hover over them first to see where they lead and don’t click on them if you’re not sure.

Look for mistakes. Many scam messages have spelling or grammar errors.

Never share personal info. Real companies won’t ask for your details this way.

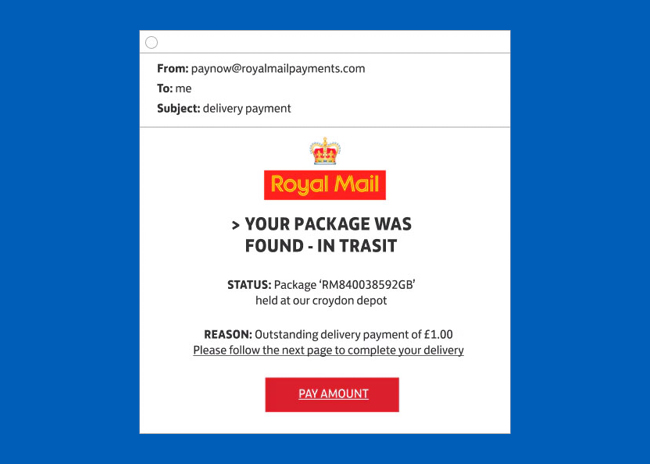

If this was a real email from the company, it would end @royalmail.com. It’s missing the customer’s name and looks rushed, with spelling and grammar errors. The suspicious links are after personal and banking details.

Avoid emails that look like this. If you’re unsure, contact the company directly or visit your account to make sure it’s real.

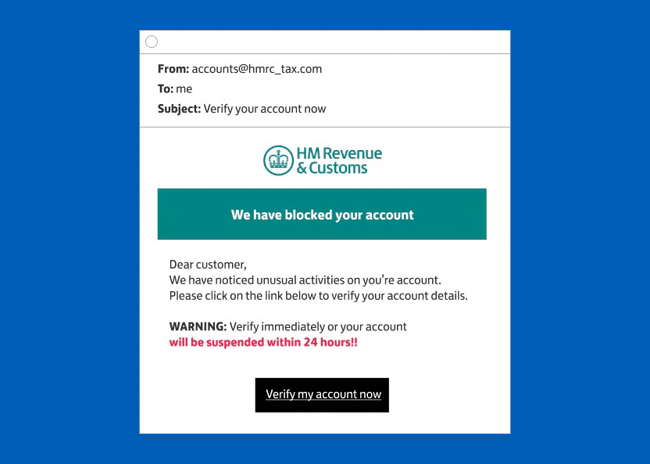

The main trick here is a threat to make you act without thinking. Real companies would usually send you a letter with your name on it before they do anything serious.

If you get an email like this, go straight to the official website to check your account. And remember, don’t follow any links in the message.

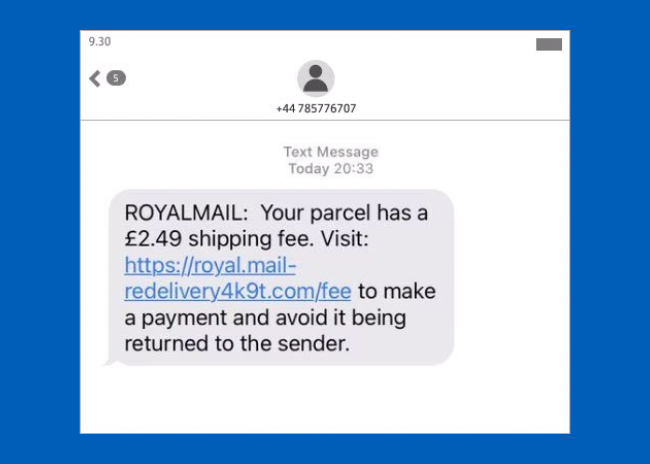

Fraudsters will chance it that you're expecting a delivery and text you with a problem.

They'll trick you by saying something like you need to pay an unexpected delivery fee. But it's a scam and they're trying to steal your details or money.

You should always check your account or order details directly with the company.

If you get a text like this, never reply. Report it by forwarding the message to 7726 and delete it.

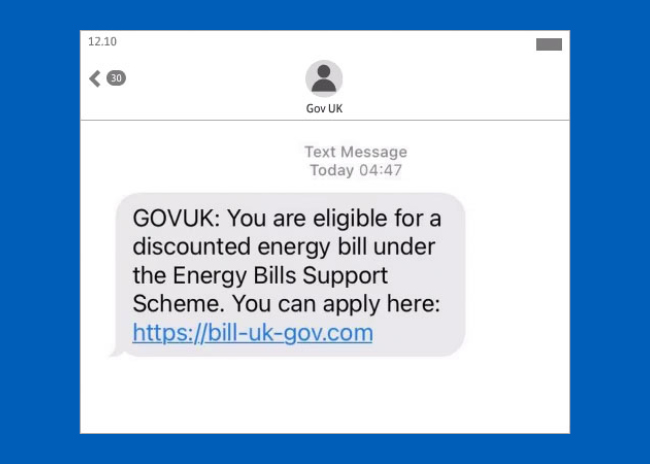

Fraudsters can use the name of a real company when they send a text. This makes the message look official and can trick you into clicking the links.

To make sure a website is genuine you can use a website checker, like the one on Get Safe Online. If nothing is found, it’s probably a scam.