Go paper-free

Amend paper-free preferences for your statements and communications.

There are three different ways of repaying your loan. These are repayment, interest-only, and a combination of repayment and interest-only.

Your monthly payment pays only the interest charges on your loan – you don't pay off any of the loan amount (see Figure 2). This means your monthly payments will be less than if you had a repayment mortgage. However, the total cost of an interest-only mortgage will be higher because you'll be paying interest on the full loan amount throughout the mortgage term.

With an interest-only mortgage, you'll need to know from the start how you're going to find a lump sum to repay the loan at the end of the mortgage term. When you apply, we'll ask you to show us solid plans that should provide enough money to repay everything you owe by the end of the mortgage term.

From time to time, we'll ask you to show us that your repayment plan(s) remains on track to pay off everything you owe by the end of your mortgage term, and you must show us if we ask you. It’s important that you keep checking that your arrangements are still on track.

If we think your plan may not be enough to repay everything you owe at the end of the term, we may contact you to discuss your plan and what can be done to put it right. For example you could consider transferring part, or all, of your loan onto a repayment mortgage.

It’s your responsibility to make sure you have enough money to repay everything you owe at the end of your mortgage term. If your plan does not give you enough money to repay everything you owe at the end of the term, you may have to sell your property.

Interest-only mortgages are only available when the loan amount is less than 75% of our latest valuation of the property.

|

Acceptable plan types |

Information you must give us |

Our assessment of acceptable values |

|---|---|---|

|

Acceptable plan types Endowment policies (UK) |

Information you must give us Copy of latest projection statement dated within the last 12 months. |

Our assessment of acceptable values Endowment companies will present three growth rates. We allow up to 100% of the projected amount using the middle figure. |

|

Acceptable plan types Stocks and shares (UK) |

Information you must give us Copy of share certificates, nominee account statement or confirmation from a recognised broker containing evidence of share holdings and their valuation. |

Our assessment of acceptable values We'll accept up to 80% of the latest valuation of the stocks and shares, ISA, OEIC or investment bond (if the latest valuation is greater than £50,000). |

|

Acceptable plan types Stocks and shares ISA (UK) |

Information you must give us Copy of latest statement dated within the last 12 months. |

Our assessment of acceptable values As above |

|

Acceptable plan types Unit trusts, open-ended investment companies (OEICs) (UK) |

Information you must give us Copy of latest statement dated within the last 12 months. |

Our assessment of acceptable values As above |

|

Acceptable plan types Investment bonds (UK) |

Information you must give us Copy of latest statement dated within the last 12 months. |

Our assessment of acceptable values As above |

|

Acceptable plan types Pension (UK) |

Information you must give us Copy of latest projection statement dated within the last 12 months. |

Our assessment of acceptable values For the purpose of backing an interest-only mortgage, we can use a maximum of 15% of the latest projected value if this projection is greater than £400,000. |

|

Acceptable plan types Sale of second home (UK) |

Information you must give us Property details, confirmation of ownership, evidence of the amount of any mortgage debt. |

Our assessment of acceptable values We'll check the ownership of the property and assess its value. We'll deduct any amount you owe that’s secured against the property and allow you to use up to 80% of the amount left over (if this is over £50,000). |

It's possible to split a mortgage between repayment and interest-only. This means that at the end of the mortgage term you'll still have an amount of the mortgage to pay off, which you'll need to do using a lump sum. So, as with an interest-only mortgage, you'll need to make sure you have solid plans to repay this amount at the end of the term.

|

Acceptable plan types |

Information you must give us |

Our assessment of acceptable values |

|---|---|---|

|

Acceptable plan types Endowment policies (UK) |

Information you must give us Copy of latest projection statement dated within the last 12 months. |

Our assessment of acceptable values Endowment companies will present three growth rates. We allow up to 100% of the projected amount using the middle figure. |

|

Acceptable plan types Stocks and shares (UK) |

Information you must give us Copy of share certificates, nominee account statement or confirmation from a recognised broker containing evidence of share holdings and their valuation. |

Our assessment of acceptable values We'll accept up to 80% of the latest valuation of the stocks and shares, ISA, OEIC or investment bond (if the latest value is greater than £50,000). |

|

Acceptable plan types Stocks and shares ISA (UK) |

Information you must give us Copy of latest statement dated within the last 12 months. |

Our assessment of acceptable values As above |

|

Acceptable plan types Unit trusts, open-ended investment companies (OEICs) (UK) |

Information you must give us Copy of latest statement dated within the last 12 months. |

Our assessment of acceptable values As above |

|

Acceptable plan types Investment bonds (UK) |

Information you must give us Copy of latest statement dated within the last 12 months. |

Our assessment of acceptable values As above |

|

Acceptable plan types Pension (UK) |

Information you must give us Copy of latest projection statement dated within the last 12 months. |

Our assessment of acceptable values For the purpose of backing an interest-only mortgage, we can use a maximum of 15% of the latest projected value if this projection is greater than £400,000. |

|

Acceptable plan types Sale of second home (UK) |

Information you must give us Property details, confirmation of ownership, evidence of the amount of any mortgage debt. |

Our assessment of acceptable values We'll check the ownership of the property and assess its value. We'll deduct any amount you owe that’s secured against the property and allow you to use up to 80% of the amount left over (if this is over £50,000). |

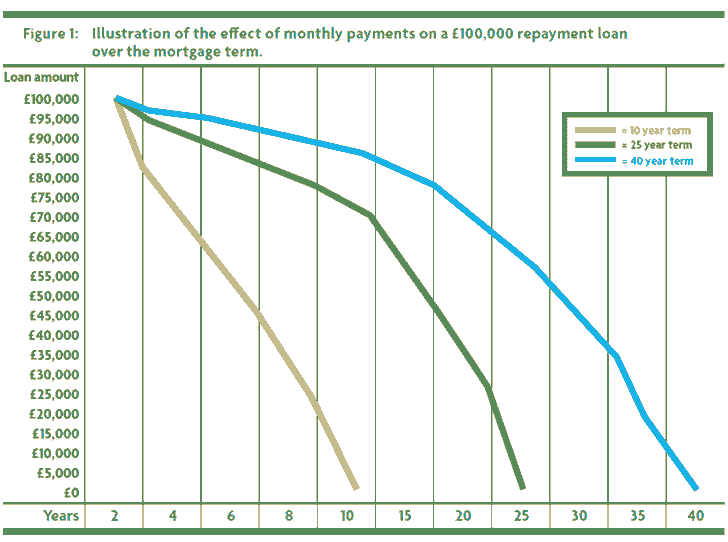

Every month, your payments go towards reducing the amount you owe as well as paying off the interest (see Figure 1). This means that each month you're paying off a small part of your loan. Your annual statement will show your loan getting smaller. However, in the early years your monthly payments will mainly go towards paying off the interest, so the amount you owe won’t go down much at the start.