Go paper-free

Amend paper-free preferences for your statements and communications.

A gifted deposit is when money is given by a family member for a deposit on a house.

If someone gives you a gift of cash for part or all of your house deposit, a mortgage lender will ask for proof that it is a gift.

This is proved by asking the person who is giving you the money, to write a ‘gifted deposit letter’. The letter shows that they don’t want you to repay the amount back. It’s sometimes referred to as a 'gifted deposit declaration’.

You’ll send this letter off to your mortgage lender with your application.

The person giving the gift must always send a gifted deposit declaration to a mortgage lender, including:

The gift giver will also need to show the following personal documents to follow anti-money laundering laws:

Other documents may be accepted or required.

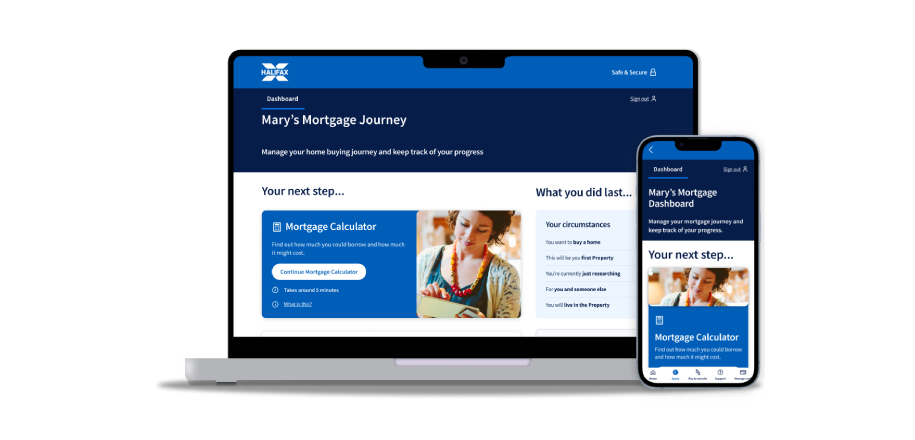

Already started your mortgage journey?