Go paper-free

Amend paper-free preferences for your statements and communications.

A joint mortgage allows two or more people to buy a home together.

Most joint mortgages are taken out by couples, whether married, unmarried or civil partners. However, two or more people can also take out a mortgage together, such as friends or even their parents.

There are a few reasons people may apply for a joint mortgage.

All the people named on the mortgage are responsible for the repayments.

Generally, lenders let you borrow around four times your yearly income. With a joint mortgage, you might be able to borrow up to four times your combined income.

There’s also the extra financial stability this offers to a lender. If one of you could technically afford the mortgage repayments alone, you might find it easier to be approved.

Yes. The only difference is that everyone who applies needs to agree on the terms. You need to make decisions together, fill in and both sign all the relevant forms.

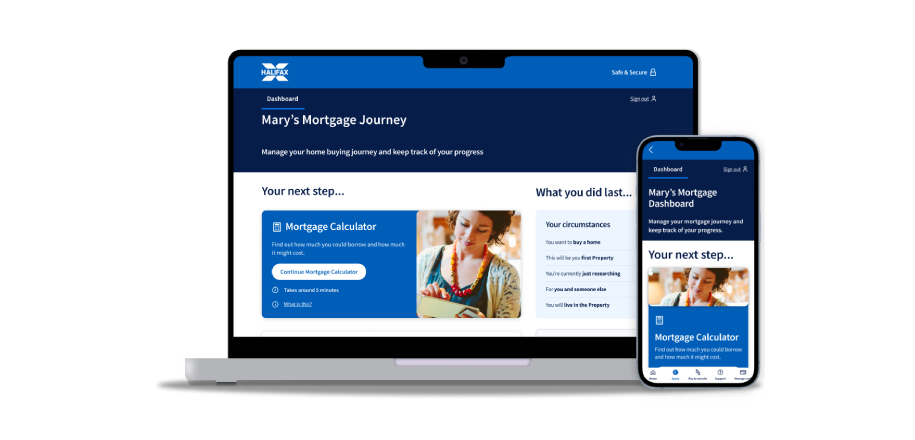

Our mortgage calculator is free to use and will show you how much you could borrow.

Once you’ve arranged a mortgage Agreement in Principle, you can then find your dream home and apply for a mortgage.

Already started your mortgage journey?

A joint borrower sole owner mortgage is a mortgage taken out with another person who does not have any ownership of the property.

The other person is jointly responsible for the mortgage payments, but not named on the property deeds.

They must meet all the lending criteria for mortgage approval and are liable to cover any payments if you miss them.

Not all lenders offer this kind of mortgage.

Yes, getting a joint mortgage with friends is possible. Normally you can take out a joint mortgage with one friend, but some lenders allow up to four people to take one out. Everyone is responsible for repaying the mortgage.

There’s a few things to consider if you buy a home with a friend.

Most lenders offer a joint mortgage with up to three other people if everyone included in the application meets the criteria and all are liable for mortgage payments.

Lenders consider the total of all incomes, allowing you to borrow more money and afford a better property. However, age and affordability can be an issue when buying with retired parents or grandparents.

The advantage of a joint mortgage is that you may be able to afford a house that would be out of your price range. Parents must acknowledge their legal liability for the mortgage repayments should their child default.

Please check the terms and conditions or speak to a mortgage expert to find out more about the risk involved with joint mortgages.

Yes, a joint mortgage can be paid by just one person. If someone proves they can pay the right amount on time, lenders will usually authorise a mortgage. However, they’ll state that all parties are liable for repaying the debt.

There’s many reasons for walking away from a joint mortgage. As a couple you may separate or, if you bought with friends, one of them might move out.

The easiest way to split a joint mortgage is to sell the property and divide the money based on how much you put in.

If you’re looking at buying a partner out of a joint mortgage, it can be more complicated.

Transferring a joint mortgage to one person is possible, but how it works depends on your situation. To make sure it is a smooth and fair process, it can help to record what everyone put in.

For example, if one person paid for most of the deposit, this makes sure they’re repaid the money if the property is sold.