Go paper-free

Amend paper-free preferences for your statements and communications.

A mortgage Agreement in Principle is the first step to getting a mortgage. It will give you an idea of how much you could borrow before you apply for a mortgage.

An Agreement in Principle (AIP) is also known as a Mortgage Promise or Decision in Principle. This is often seen as your first step to buying or remortgaging a home.

When you apply for an Agreement in Principle, the lender will ask about your finances and look at interest rates to work out what you can afford to repay. It’s not a guarantee, as you’ll need to go through the mortgage application process. But it could help you understand the amount you could borrow before you apply for a mortgage.

It’s obligation-free and only involves a soft credit check, which means there’s no impact on your credit score.

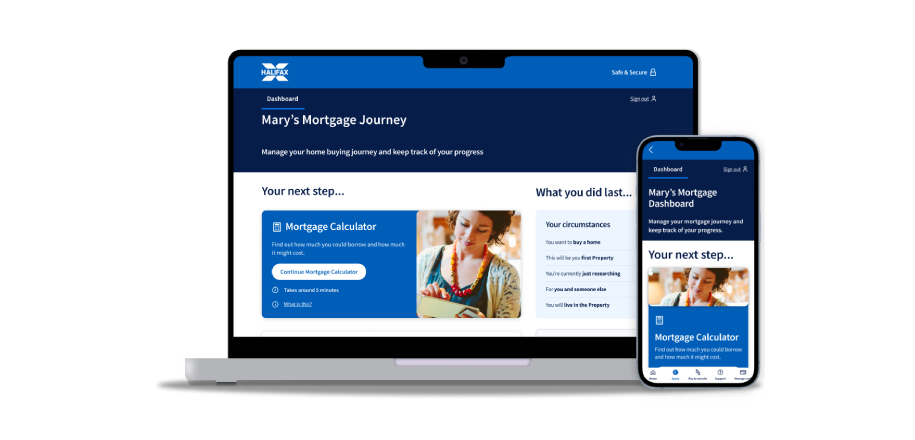

Already started your mortgage journey?

See how much it might cost to buy your first home.