Go paper-free

Amend paper-free preferences for your statements and communications.

A property chain is where a group of home buyers and sellers are connected.

If you want to buy a house but must wait until the seller buys their next home, you’re in a property chain.

At the start of the chain, only buying.

Selling their home to a first time buyer and purchasing a new home from a retiree.

Selling their home to the homeowner and moving in with family.

This is a two-person chain, as there are two house purchases that need to take place.

Communication is key to avoid a broken chain. Speak to your conveyancer or estate agent for regular updates.

A chain-free property is one that doesn’t rely on any other transactions to happen before its sale or purchase can go through. This can also be called ‘a property with no onward chain’.

Some common examples of chain-free properties include:

If a sale falls through, it affects everyone in the chain. This means you could lose money you’ve already invested in your house purchase. You may also have to put your property back on the market and lose out on your dream home. This can be stressful and disappointing.

Some reasons a chain may break are:

Sadly, most property chain breaks will be out of your control, such as when another buyer pulls out of the sale. However, there are ways you can protect your home and money.

If you have Home Buyers’ Protection insurance, you can claim back some of the money you’ve lost in fees if your house sale falls through.

Some estate agents may also offer a guaranteed sale. This means they’ll buy the property from you if they fail to sell it in a set timeframe.

No onward chain means the buyer or seller doesn’t rely on another transaction before the sale or purchase can go through.

This can be a good alternative to chain properties, as you won’t have anyone above you in the chain who could affect your purchase.

A house chain can take a few months to reach completion, depending on how many parties are involved.

Generally, the longer the chain, the longer it will be until you get the keys to your new home.

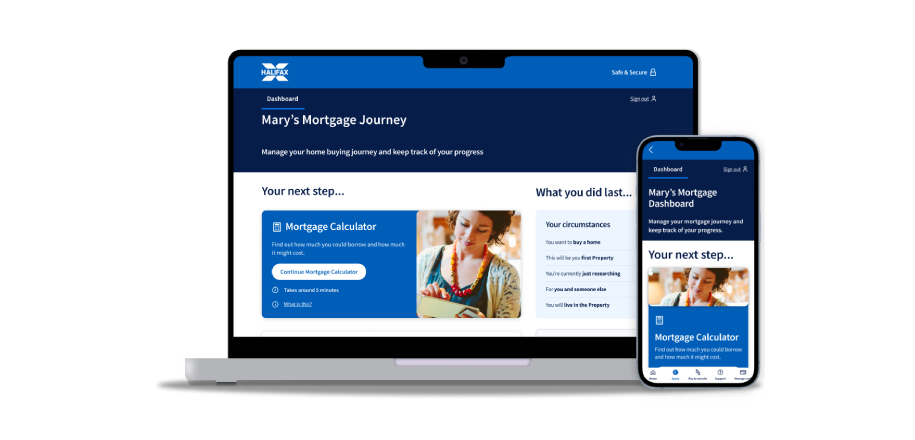

Already started your mortgage journey?