Go paper-free

Amend paper-free preferences for your statements and communications.

Find and apply for the right mortgage with a little help from us. Whether you want to take that first step or plan your next move, your search starts here.

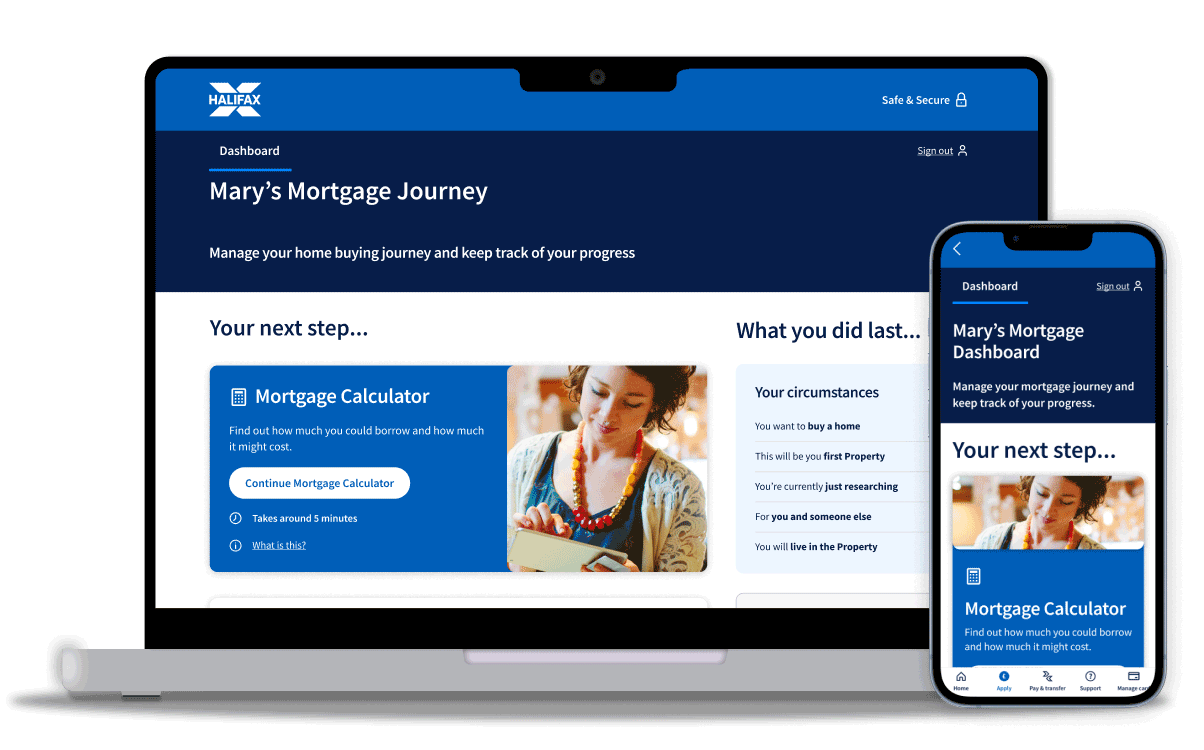

We make your mortgage journey simple

Track and manage your mortgage application online with your own mortgage dashboard. Upload documents, pick valuation options and get support, all in one place.

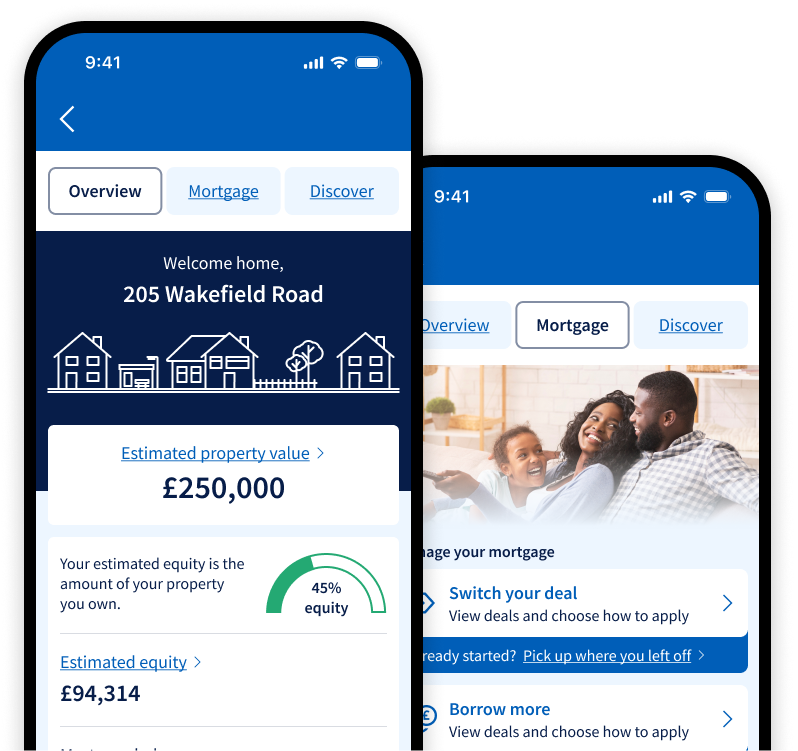

HelloHome on the Halifax app lets you track your rate and payments. Learn about your property value and equity. Even switch and save on household bills.

What is the Mortgage Charter?

It’s a voluntary agreement between mortgage lenders and the government to give mortgage customers extra support during this difficult time. You can find full details on the government’s page.

It offers a range of options that could help you stay on top of your mortgage payments.

The options are to:

None of these options will impact your credit score.

What support does the Mortgage Charter offer for mortgage customers?

If you can afford to make your current monthly payment amount - you should avoid making interest-only payments or extending your mortgage term where possible because you’ll pay more interest overall.

If you’re coming to the end of your current deal, you’ll be able to agree a new rate 4 months in advance of your current deal ending.

You can find out more about each option on our support for our mortgage customers page.

Your home also can’t be repossessed for at least 12 months from the first missed payment without consent if you go into arrears, except under exceptional circumstances.

Let us know if you’re concerned about your mortgage payments. The sooner you get in touch, the more options you’ll have.

Can I get more support?

You can find out more about what you’ll need for each option at our support for our mortgage customers page.

Can I cancel payment arrangements made under the Mortgage Charter if I change my mind?

Yes. If you make interest-only payments for 6 months, you can cancel whenever you like within the 6 months. You won’t be able to apply again once you’ve cancelled.

You can let us know by completing our Interest-only payments cancellation form

You can also cancel a mortgage extension within the first 6 months without an affordability check.

If you’ve made any other changes to your mortgage, such as extra borrowing, more checks may be needed.

My current deal is coming to an end soon and I’m worried about rates continuing to rise – when can I talk to you about a new deal?

As long as you have 4 months or less left on your current deal, you can secure a new rate.

Will I have to pay an early repayment charge (ERC) to switch to a new deal?

If you’re in the last 4 months of your current mortgage deal you can select a new rate to start when your current deal ends, without any early repayment charge. If you’re in the last 3 months of your current mortgage deal you can select a new rate to start straight away with no early repayment charges.

Will I get the same mortgage rates online as I would if I phone?

Yes. We offer the same rates online and over the phone.

Could my mortgage offer be withdrawn if changes are made to the Halifax mortgage range?

What can I do to secure a mortgage rate with you?

If you are not already a mortgage customer with us, you must complete a full mortgage application, either online or with a mortgage adviser, to secure a mortgage rate.

If you already have a mortgage with us, you’ll need to complete an application for a new deal, either online or with a mortgage adviser. If you’re in the last 4 months of your current deal, you can select a new rate to start when your current deal ends with no early repayment charge (ERC). If you’re in the last 3 months of your current mortgage deal, you can select a new rate to start straight away with no early repayment charges.

Find more information about switching your deal on our existing customer support pages.

If your existing deal has more than 3 months left to run, you can still switch your deal, but we won’t waive the ERC in most cases.

Important: An agreement in principle (AIP) isn’t a mortgage offer. Once you’ve completed an AIP, you’ll need to complete a full mortgage application to secure your rate with us.

I’m in the process of switching to a new deal - am I able to select a different deal instead if I’ve changed my mind?

Yes. If you already have a mortgage with us and have arranged to switch to a new deal, you can select a new deal up until the date your change takes effect.

If I am unsure about the best option for me, what should I do?

There is a lot of useful information on our website, but you can also contact our mortgage advisers to help you figure out your best option.

Can I get more information about my existing mortgage or my application for a new mortgage?

If you already have a mortgage with us, you can log in to online banking to check your details. To make any changes or see what your option are, visit our existing customer page.

If you’re a first-time buyer, a home mover, or you’re moving your mortgage to us and your application is already in progress, you can find updates on your Customer Tracker. You’ll find the link for this in your email invitation, or you can contact your mortgage adviser.

I’m worried about my finances, what can I do?

We know it can be hard to talk about money - we’re here to help. You’ll find lots of information and tools online, but if you’re worried you might not be able to make a payment, get in touch as soon as possible.

Once we understand your situation better, we can talk through your options together. Talking to us won’t affect your credit file. If any of the options we talk about does affect your credit score, we’ll explain what this means for you before we set anything up.

If you miss any payments, this could affect your credit score and how you borrow in the future.

There are also other people you can talk to for independent help and advice. They can talk to us on your behalf if you’d prefer them to.

Financial support organisations

If you would like free independent advice, view our financial support organisations.

If you’re planning to house Ukrainian refugees, we fully support you.

Find out how we’re making the process as simple as possible.

We want to make sure you know about our other help and guidance options. Here’s one that might suit you.