Go paper-free

Amend paper-free preferences for your statements and communications.

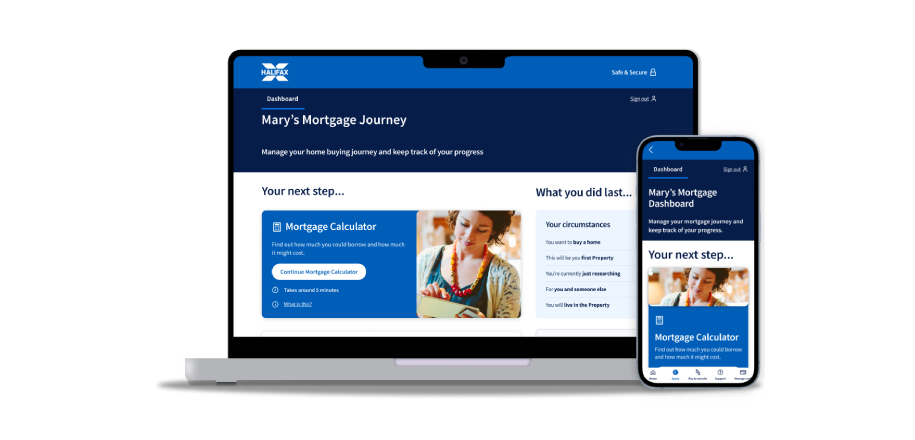

Buying a new home is exciting. But whether it’s your first time or you’re moving home, the process can seem a little overwhelming.

Don’t worry, we’re here to help you with our step-by-step guide.

Learn how to apply for a mortgage and how the mortgage application process works with Halifax.

Follow our 5 simple steps:

It takes around 10 minutes to complete and we’ll give you a decision right away.

If you’re self-employed, your lender may also want to see proof of:

It could take up to 6 weeks to get an offer following a mortgage application. The exact time depends on any hold-ups when you’re applying, such as the time it takes to look over your finances and arrange a valuation.

Lenders will do their best to make sure it’s a smooth mortgage application process, but hold-ups can happen.

The most common reason why an application might be delayed is waiting for documents. Make sure to send over any paperwork needed and keep in touch with your lender to check how things are progressing and see if you need to do anything.

In most cases, an agreement in principle is valid for 90 days. You might be able to refresh your terms after 90 days.

Once the lender is happy everything’s in order, they’ll make you a formal mortgage offer, which is usually valid for up to six months.

Already started your mortgage journey?