Go paper-free

Amend paper-free preferences for your statements and communications.

You can be your own boss and get a mortgage for a new home.

Most lenders need two or three years of accounts as proof that you can afford to repay the mortgage. However, it's still possible to get a mortgage under that timeframe if you have a good credit score and a sizeable deposit.

If you were working full-time previously, your pay slips from this time may be acceptable.

You may just need to give a little more information to your mortgage lender to show that you can keep up your monthly repayments:

You may also have to provide proof of accounts certified by a registered accountant.

If you’re a small business owner, you may need to give some more information like:

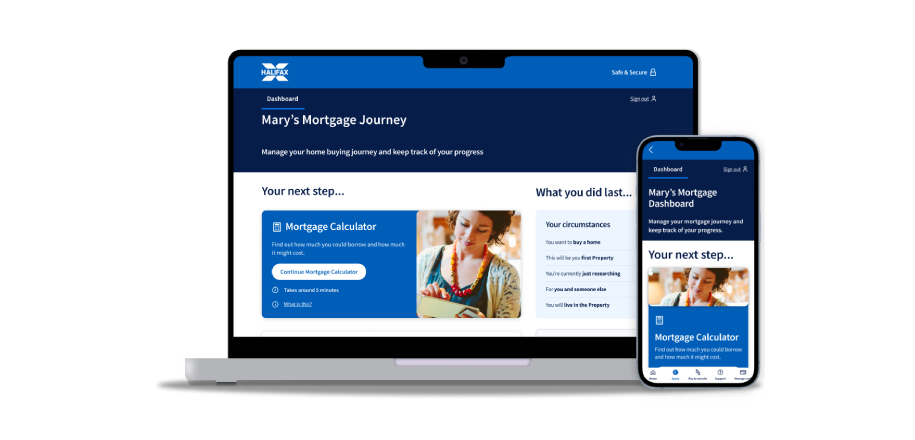

Already started your mortgage journey?