Go paper-free

Amend paper-free preferences for your statements and communications.

Loan to value (LTV) is the percentage of borrowing you take out against your home.

Loan to value ratio, or LTV, is the ratio of what you borrow as a mortgage against how much you pay as a deposit.

Here’s how loan to value ratio works:

Lenders look at your LTV when deciding if they’ll accept your mortgage application.

A low LTV can mean less risk for the lender so the lower your LTV the better.

Not only will this support your mortgage application, but it will also help you get a lower mortgage rate.

Your LTV will be reviewed whenever you remortgage, or if you’re a first time buyer.

Most lenders consider anything under 80% to be a good LTV ratio but will vary by lender.

While it’s sometimes possible to borrow extra, anything above 80% tends to cost more.

If you can, increase your deposit to lower your LTV.

Lenders will be happier if you’ve already got a decent amount of equity in your home.

They see this as being a lower risk due to the property value being greater than the value of the mortgage.

A loan to value ratio that is high, or stays the same over time may mean higher interest rates.

Equity is how much of your home you ‘own’.

Mortgage equity is the difference between what you owe on your mortgage and the current value of your property.

The best way to improve your loan to value ratio is to increase the amount of equity, so you don’t need to borrow as much.

You can do this by:

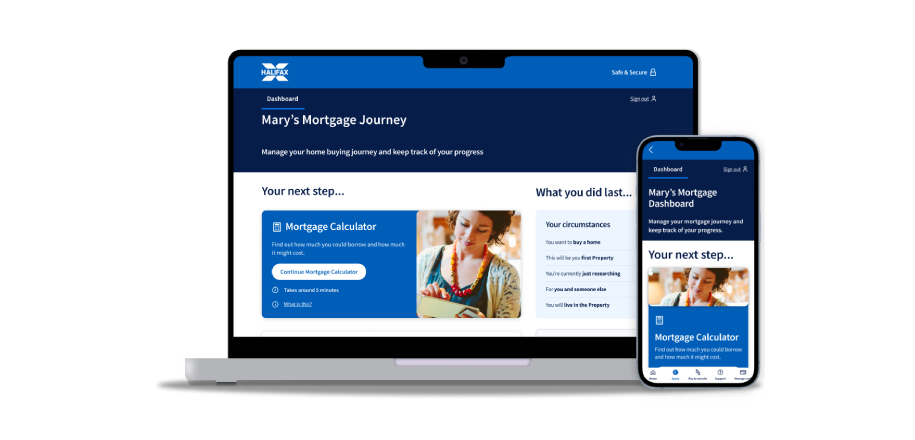

Already started your mortgage journey?