Go paper-free

Amend paper-free preferences for your statements and communications.

Lenders will secure your mortgage against your home. So, to be eligible for a mortgage, a lender wants to be confident you can pay back the money you borrow. If you can’t keep up your monthly mortgage payments, you could lose your home.

Different lenders will use different things to decide if they’ll accept you.

These might include:

While different lenders have different rules, these are the common areas they’ll usually consider:

There’s no sure-fire way to guarantee that you’re accepted for a mortgage. But there are things you can do to help increase your chances.

You’ll have to show proof of who you are and that you can afford your mortgage.

You’ll need:

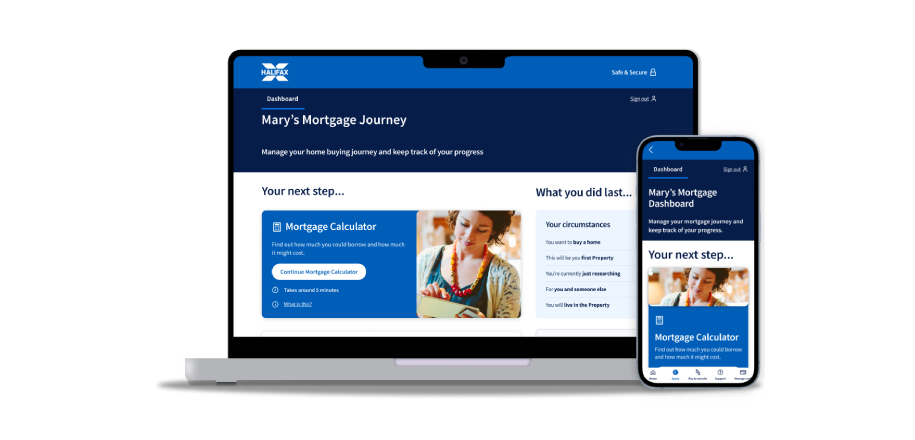

Already started your mortgage journey?